China Exports Record in June: Europe Pays the Price

China reports record exports in June. Europe and Germany are paying the price - with growing deficits and declining market shares in global trade.

The new export record in June shows that China is expanding its trading power, while Europe is falling behind. China's exports recorded an unexpected increase. Data from the customs authority shows an increase of 5.8% compared to the previous year. This growth significantly exceeds analysts' forecasts. A provisional trade agreement with the USA has led to a fragile truce in the customs dispute. At the same time, China is directing its flow of goods to other regions - with drastic consequences for Europe and Germany in particular.

Europe loses out in the global trade war with China

Trade with Europe increased by just 2.5% in the first half of 2025 compared to the previous year. However, this figure conceals a significant shift in the balance between the trading giants. Exports from China to Europe rose by 6.6%, while imports from the EU fell by 5.9%. As a result, China's trade surplus with the EU grew by 21% within a year. The change in the flow of goods with Germany is particularly dramatic. A 10.6% increase in exports to Germany contrasts with a 5.2% loss in imports. China's trade surplus with Germany thus increased by no less than 180% within one year.

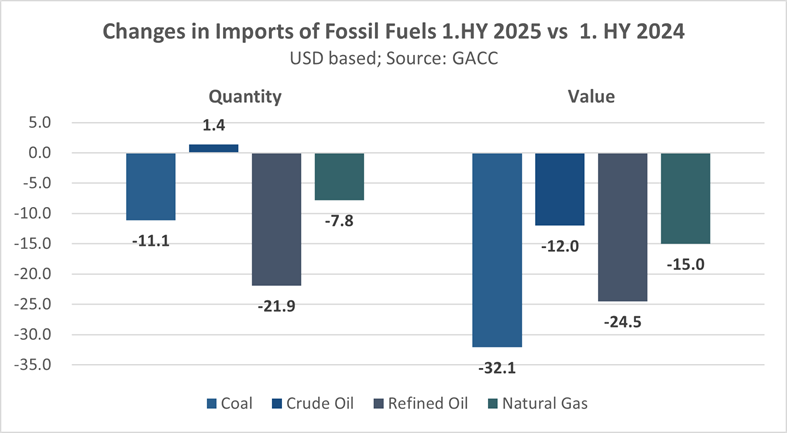

One ray of hope from a Chinese perspective is the 1.1% increase in imports in June, the first growth this year. For the first half of the year, imports are still down by 3.9%. China is reducing its dependence on fossil fuels. Only 1.4% more crude oil was imported in the first half of the year than in the previous year. The volumes of other energy sources fell.

Prices fell much more sharply than volumes. The ratio was around 1:3 for coal and twice as much for gas. Crude oil became around 17% cheaper, while the price of refined oil products remained stable. This affected commodity-exporting countries such as Russia, whose imports fell by 9.6%, South Africa (-14.2%) and Brazil (-16.2%). Trade with the BRICS countries weakened and fell to 9.5% of China's total trade.

ASEAN expands its role as a global trade player

Exports to the USA fell by 10.9% in the first half of 2025. In contrast, exports to neighboring Asian countries, particularly the ASEAN states, rose by 13.0%. Deliveries of goods to the USA therefore only accounted for 11.9% of China's total exports, compared to 14.1% in the previous year. The share of ASEAN countries grew from 16.7 percent to 17.8 percent. The ASEAN states are further expanding their role as "bridge countries" between China and the USA and Europe.

Data from the customs authority shows that the expected catch-up effect from the provisional agreement in the tariff dispute failed to materialize. In June, exports to the USA fell by a further 16%. Interestingly, according to calculations by the analysis company Descartes, only around 3.5 percent fewer containers landed in US ports. Either the Americans are only buying junk, or the containers mainly contain air.

The customs authority's half-year figures provide a snapshot. It remains unclear what the post-Trump era will look like. Will the tariffs imposed remain in place? Is Trump doing the TACO again? Are the recently announced 100 percent tariffs on countries that buy Russian raw materials imminent? However, some trends have emerged in recent months:

The EU as a victim of Trump

The EU and Germany in particular are victims of Trump's tariff policy. China is channeling more goods into the EU and Germany at low prices. The member states are hit threefold. Firstly, China is flooding the EU with cheap goods, which is threatening domestic industry in its very own territory. Secondly, China is reducing its imports from the EU, which increases China's trade surplus. Thirdly, the EU and China are competing for sales markets in third countries, with the better end for China, as the Middle Kingdom subsidizes its industry.

However, the EU is not just a helpless victim, but rather a toothless tiger. After the USA, it remains the second largest market in terms of direct and indirect exports. China cannot afford to be shut out of this market. A double front would be an economic fiasco for China. The EU's triumvirate in terms of China trade policy, Ursula von der Leyen, Valdis Dombrovskis and Kaja Kallas, hold a good hand that must be played well at the upcoming summit in Beijing at the end of the month.

BRICS countries fall behind in China trade

The BRICS alliance appears to be on the sidelines in Beijing. There may be many reasons why Xi Jinping did not fly to Rio for the summit. One is certainly that the alliance is playing a less important role in supplying China. China is noticeably reducing its demand for raw materials. Its allies are suffering the consequences. China prefers to look to the free market, to countries such as Qatar, Bahrain or Australia. In terms of trade, the partners with "unlimited friendship", Russia and China, are moving away from each other. The threat of 100 percent punitive tariffs for countries that still purchase raw materials from Russia in 50 days' time, should there not at least be negotiations between the two warring parties, presents China with a Faustian question as to whether it will stand by its hated friend with Nibelung loyalty or whether its shirt is closer than its pants.

Even if the figures initially suggest otherwise, China remains dependent on US orders. Domestic economic weaknesses are forcing Beijing to support the economy with massive borrowing. The dissatisfaction with the customs authority's interim report is reflected in the fact that this support is continuing.

The dangerous game of the ASEAN states

The ASEAN states are expanding their role as bridge builders between East and West and are profiting handsomely. However, this is coming under the watchful eye of the Sauron of Washington. Vietnam and the other federal states came through the second round of tariffs unscathed. But they are just one angry outburst away from a tariff cudgel destroying their business model.

It remains as it was. The customs statistics are a snapshot. The chaos that Trump is unleashing is paralyzing everyone involved. Chaos is the only strategy Trump knows, and customs policy is the only foreign policy instrument he has mastered.