China in May: Car Market in the Stranglehold of Discounts

Sales records and subsidies mask weakness: China's car market only grew in May thanks to discounts and bonuses. Tesla loses significant ground.

The car market in China continues to grow in May, but the picture is dominated by discounts and premiums. The record figures conceal a development that is increasingly characterized by government support and price pressure. Actual demand remains weak and the industry is reacting with sales and incentive policies.

Generated by AI (DALE-E3)

At first glance, the figures seem impressive. Retailers recorded 1.94 million vehicles sold, an increase of 13.3% compared to the same month last year and 10.1% more than in April. Wholesale and production also grew significantly, each by more than 12 percent. Nevertheless, the pace has slowed compared to previous months. The market is increasingly dependent on external stimuli in order to continue to grow at all. Although a reduction in stock of 110,000 vehicles indicates a certain level of efficiency in sales, it is primarily an expression of the high sales efforts.

Subsidy dominates new car market

These efforts would hardly be conceivable without the state-subsidized scrappage premium. Around 70 percent of private buyers took advantage of this support when exchanging their vehicle. Although this stimulated the market in the short term, the structure of demand is changing significantly. Only 30 percent of new cars are now purchased by first-time buyers. This shows just how much the current market dynamics depend on one-off purchase incentives and how little is generated by consumers' own purchasing power.

Demand is also being driven by price reductions. Although the price war has calmed down somewhat, discounts remain at a high level. For vehicles with alternative drive systems, the average discount in May was 11%, a slight increase on the previous month. Discounts for classic combustion engines remained stable at 22.5 percent. In addition to open discounts, hidden benefits such as better equipped models or longer warranties also provide additional incentives. Domestic brands in particular, such as BYD, Geely and Chery, systematically use these levers. Their share of the retail market climbed to 64.9 percent, while their share of the wholesale market rose to 69.4 percent. This development illustrates how aggressively Chinese manufacturers are securing their position in the domestic market.

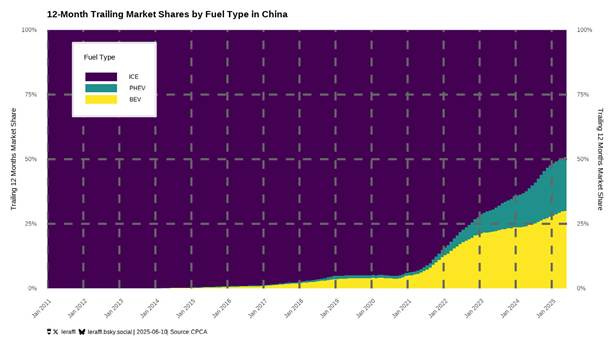

Vehicles with alternative drive systems are receiving a particular boost. Their share of retail sales rose to 52.9%, which is significantly higher than the previous year's figure. In the same period, sales of combustion engines fell slightly. The market share of purely electric vehicles was 31.4%, making it the strongest subgroup among the so-called NEVs. The manufacturers' strategic focus on this form of drive is having an impact, even if it is heavily influenced by governmental framework conditions.

Tesla in China: Model Y strong, rest slumps

Tesla achieved a respectable success in this environment. The Model Y was the best-selling SUV in May with 24,770 units. However, the lead over the Song Plus from BYD and the Xingyue L from Geely was narrow. Over the period from January to May, Tesla was able to outperform the Song Plus, albeit with decreasing momentum. At the same time, the overall results reveal weaknesses. Tesla sales fell to 38,588 vehicles in May, a drop of 30 percent compared to the previous year. The figures from January to May also show a drop of 7.8 percent. The slump is particularly pronounced for the Model Y itself, which lost 38% year-on-year. Despite the new "Juniper" facelift, which has been available since February, price pressure from local competitors remains high. Tesla's position is therefore ambivalent: a strong model in individual comparisons, but a weakened overall picture.

Exports remain a stabilizing element. After stalling in the previous months, positive trends are now emerging again. From January to May, 640,000 vehicles with alternative drive systems were sold abroad - almost twice as many as in the same period last year. This largely compensated for the 14 percent decline in exports of vehicles with combustion engines. A slowdown is particularly noticeable in deliveries to Russia. Nevertheless, Chinese brands continue to hold a market share of over 55% there, even though the first signs of a slowdown in sales are becoming apparent.

More sales, less stability

Despite these rays of hope, the overall trend remains fragile. Growth is heavily dependent on external factors, while the structural strength of domestic consumption remains weak. Manufacturers are under pressure due to falling margins and many are dependent on government aid. The financial situation of individual suppliers is worsening noticeably, such as BYD, whose rising debt is increasingly perceived as a burden for the entire industry. At the same time, the growing spread of electric vehicles is changing the energy market: national crude oil consumption is falling, which is also reflected in imports. Russia in particular is suffering here.

Overall, the Chinese car market in May remains an example of growth on a shaky foundation. Strong figures alone are not enough if they are only achieved through discounts, premiums and government incentives. The pressure on manufacturers to develop viable business models remains.